Eligibility Understanding eligibility

This page gives a brief overview of Fund eligibility rules. The information has been provided to help you understand how participants become and remain eligible for benefits offered through the UNITE HERE Local 11 Health Benefit Fund.

How to check eligibility

Logging in to the secure Member Portal is the easiest way to check your current eligibility status.

Step 1: Log in to the Member Portal.

Step 2: Once you are logged in, click Benefits tab in the menu bar.

Step 3: Once you are eligible, your options will show up on this screen, and you can begin the enrollment process.

Don’t have an account? Click here to register.

You can also call the Benefit Administrative Office at (866) 345-5189 and a staff member will assist you.

- Eligibility rules

- Extended Eligibility for Disability Credit

- Family and Medical Leave Act

- How to become eligible for benefits

- Maintaining eligibility

- Enrollment

Eligibility rules

The UNITE HERE Local 11 Health Benefit Fund provides health benefits to more than 10,000 Local 11 members and their dependents in the hospitality industry. Because employers contribute to the Fund as required by Collective Bargaining Agreements, your Union contract determines what Fund Plan you are eligible for. Each Fund Plan has different eligibility rules and covered benefits.

| Plan Name | Industries |

|---|---|

| UNITE HERE Plan | Workers from hotels, airports, some universities, and other employers |

| UNITE HERE Event Center Plan | Workers in seasonal or event centers, or other food service like cafeterias |

| UNITE HERE Restaurant Plan | Primarily restaurant workers |

Extended Eligibility for Disability Credit

If, after becoming eligible, you are unable to work the Minimum Required Hours in a month because of an injury or sickness, as certified by your doctor, you will be given disability credit for each month you are disabled, as follows:

For up to 6 months if the injury or sickness was incurred outside work

For up to 6 months if the injury or sickness was incurred while working

If you are working for an Employer who employs 50 or more employees when you become disabled, you may qualify under the federal Family Medical Leave Act (FMLA) for extended coverage during a period of FMLA leave from your Employer. If you qualify for FMLA leave, you must use that first before using your disability credit. See the Family Medical Leave tab on this page for more information.

Disability credit is provided as if you worked the Minimum Required Hours in a month and will continue your eligibility for the third month after the month for which the credit is given. See the Summary Plan Description on the Find Forms & Documents page for rules and restrictions.

Family and Medical Leave Act

The federal Family and Medical Leave Act (“FMLA”) generally requires covered employers to permit eligible employees to take up to 12 weeks of unpaid, job-protected leave each year (26 weeks in certain circumstances)

To the extent required by the FMLA, your Employer must continue to pay for your health coverage under the Plan during any approved FMLA leave. If your coverage ceases during the FMLA leave (for example, because you opted not to continue coverage or due to nonpayment of your share of the premiums), you may resume your coverage upon return from leave on the same terms that applied before the leave was taken.

The leave may be taken for one of several reasons that are specified by law. Details concerning FMLA leave are available from your Employer. Requests for FMLA leave must be directed to your Employer; the Administrative Office cannot determine whether or not you qualify.

How to become eligible for benefits

Eligibility rules are simple but slightly different depending on your plan.

UNITE HERE Plan and Restaurant Plan

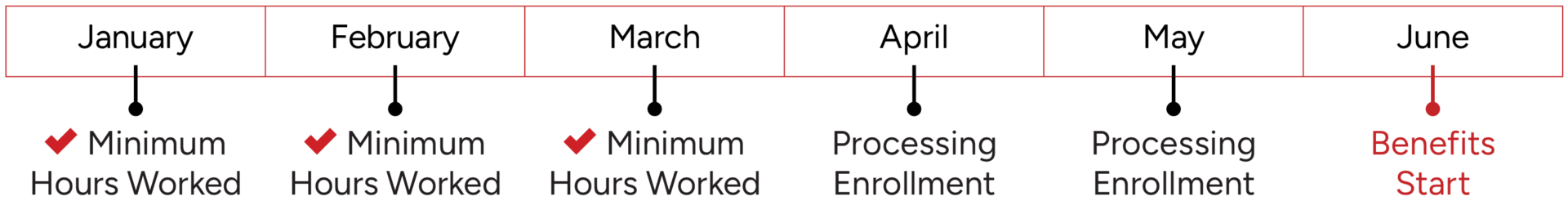

If you are a new hire and need to build up eligibility for the first time or re-establish your eligibility after losing eligibility, you will only need 3 consecutive months of working with a minimum of 60 hours worked (or paid from your employer) to become eligible. Your coverage begins at the start of the 6th month as in the chart below.

Example: Maria works at least 60 hours in January, February and March. In March she fills out enrollment forms. Her coverage will begin June 1st.

Once you’ve achieved eligibility, you can enroll at any time! If you work for more than one employer, you can combine your hours to reach 60 hours.

Event Center Plan

For the Event Center Plan, for a new hire the rules are the same except that the minimum hours required is 100. If you work in multiple event centers, your hours will be combined. If you work for one or more event center employers, and ALSO work for a UNITE HERE Plan or Restaurant Plan employer, you will only need 60 hours per month.

Maintaining eligibility

Once your eligibility is established, you will remain eligible as long as you continue to have the Minimum Required Hours Worked each month for one or more employers, and the employer(s) make(s) contributions to the Fund as required by a Collective Bargaining Agreement or Participation Agreement.

| Fund Plan | Minimum required hours |

|---|---|

| UNITE HERE Plan | 60 |

| UNITE HERE Restaurant Plan | 60 |

| UNITE HERE Event Center Plan | 60 hours (grandfathered group). 80 hours (if you have more than 5 years reported to the Fund but are not grandfathered). 100 hours (if you have less than 5 years reported to the Fund) |

Here’s how it works – After your initial eligibility is established, Hours Worked during each month determine eligibility for the third following month, as shown in the following Eligibility Table:

| Work Month: | Coverage Month: |

|---|---|

| January | April |

| February | May |

| March | June |

| April | July |

| May | August |

| June | September |

| July | October |

| August | November |

| September | December |

| October | January |

| November | February |

| December | March |

If fewer than the minimum hours are reported for you for a work month, you will have a lapse of coverage following the same rules as above. For example, if you work fewer than the minimum hours in January, you will not have coverage for the month of April.

You can also lose eligibility due to late or non-payment of Employee Contributions, or employer’s withdrawal. If you didn’t work enough hours due to FMLA, disability, or military leave, you or your employer must take action to continue your coverage.

For complete eligibility rules, see the Summary Plan Description in the Find Forms & Documents section of the website.

Enrollment

When you become eligible, the Benefit Administrative Office will send you a mailing to let you know that you are eligible to enroll for benefits. You can enroll any time after you become eligible- there is no deadline!

With the UNITE HERE Local 11 Health Benefit Fund Member Portal you can review eligibility and elect benefits securely from the web or your smart phone.

You can create your account at any time. Once you reach eligibility, your benefit options will be added automatically, and you will be notified.

All plan participants will need to register for online access to the new Portal before they can begin enrolling in benefits or make changes.

We’ve provided instructions to help you create your account and complete the enrollment process online. Visit the How to Enroll page for more information.